Other articles in the 2019 May Newsletter:

At the 2019 Joint Provost/Senate Retreat, Vice Provost for Academic Operations Mark Todd provided an explanation of how Revenue Center Management System (RCM) works at USC. The objective of RCM is to promote decentralized financial decisions by holding deans responsible for generating revenues and managing finances within their own schools. Individual schools control the revenues they generate subject to “taxation” for strategic initiatives and common or shared overhead costs. This system enhances accountability by creating a decentralized decision-making environment and linking schools’ academic and operating decisions with their financial impact. While RCM fosters a decentralized management environment, it can also reinforce a siloed or federated system.

Related: Working Across Schools: Breaking Down Barriers

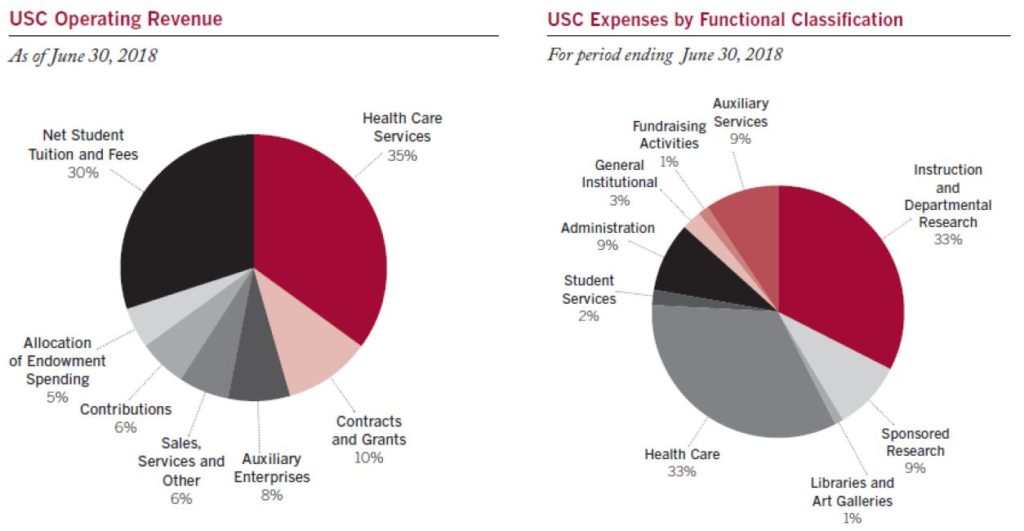

Todd provided an overview of USC’s $5.27 billion dollar budget. He used information taken from USC’s annual report to provide examples of how RCM functions at specific schools by explaining how revenues flowed into schools, how school revenues are taxed, and how revenues are spent on school activities.

The amount and nature of schools’ revenues vary significantly based on the school size, its undergraduate and graduate populations, and the nature and scale of its clinical, research and other activities. In all cases, schools control the revenues they generate under RCM subject to a system of taxation for common overhead costs and tuition. All schools are forced to budget to a surplus.

Examples of RCM “taxes” on schools’ revenues include:

- Student Aid Tax for undergraduate financial aid – 30% of undergraduate tuition

- Participation Tax for school academic priorities – 10% tax on revenues

- Facilities Improvement Tax for deferred maintenance and upkeep – 4 to 5.7% tax on tuition

- Tech Connection Charge for data lines – variable charge per employee

- Allocated Central Costs for central administration costs – fixed charge

Todd provided contrasting examples of how the RCM system resulted in a large research intensive school with 64% of its available revenues available to spend versus a smaller teaching intensive school with 47% of its revenues available.

On average, 61% of overall USC school revenues are available to spend after taxes.

Mark Todd oversees the financial and business functions, capital projects, space management, organizational reviews for academic support operations, and the coordination of strategic planning.

Ruben Davila

Academic Senate Administrative Vice President

Clinical Professor, Leventhal School of Accounting

Marshall School of Business